The three factors of increasing mortgage rates, low housing inventory, and high prices will most likely combine to present the following situation for mover volumes for the rest of the year.

Housing inventory

Inventory will stay low but still follow the standard seasonal trends with possible higher levels reached during peak season which is Easter – Labor Day. Increasing rates may push more sellers to put their houses on the market before higher rates dry up the pool of buyers.

Foreclosures

Foreclosures should remain low due to the good positioning of existing homeowners. This should also keep the volume lower.

Rising rates

Rates will rise but at a slower speed, which will cool the market for buyers and increase inventory, but not so much as to put people off of moving.

Home prices

Home prices should remain fairly stable for the short term until rising rates reduce the number of buyers on the market. The inflated house pricing does give movers an incentive to sell sooner whilst there is still a market for buyers. This could lead to increased inventory over the summer period before rates rise to higher levels in the fall.

Renters

Due to the low housing inventory, the number of new movers that are renters will likely increase compared to where we have normally seen them.

Let’s dive into the details that lead us to these predictions for pre-movers and new movers.

Speedeon observations on the factors affecting the real estate market and new movers

Looking at Speedeon’s mover data over the past months we have seen:

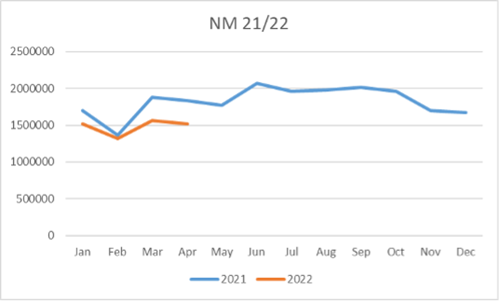

- Our New Mover data mirrors what is seen in the industry at large. Lower volumes than last year but continuing to follow traditional real estate market seasonal trends. The continued shortage of inventory shows in the numbers but does show promise for increases later on in the year.

- We did see a lower dip in February this year compared to last with the volumes so far this year seems more stable.

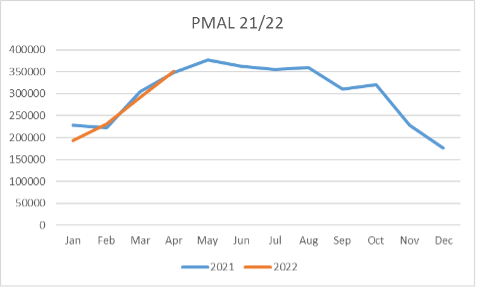

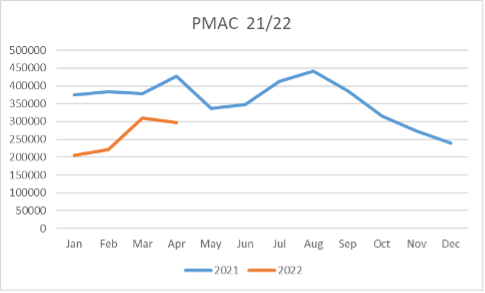

- Pre-mover counts work as a good crystal ball for mover counts. Both of these show positive volume trends, with PMAL matching last year’s totals, and PMAC (whilst starting slower at the beginning of the year) has shown a sharper increase in Feb and Mar than last year.

Real estate industry observations

Inventory is low but catching up with last year.

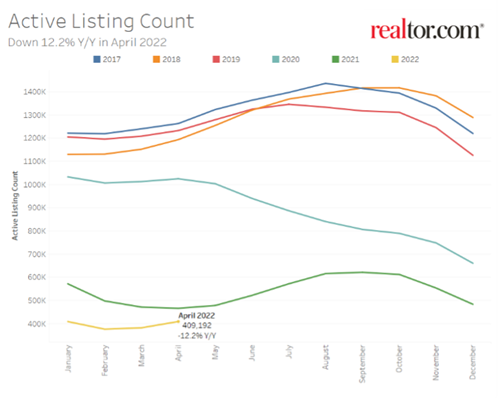

Realtor.com provides an in-depth look at volumes (Realtor.com Article).

The national inventory of active listings declined by 12.2% over last year, while the total inventory of unsold homes, including pending listings, declined by 10.7%. This went along with the inventory of active listings being down 60.1% compared to 2020, right at the onset of the COVID-19 pandemic. In effect, this means that there are now only 2 homes available for sale compared to 5 that there were previously.

Real estate inventory seems to match seasonal trends, with more houses on the market compared to last year. But as stated, there is still a reduction in inventory year over year.

However, this decline is smaller than the previous months, 12.2% for April compared to a year-on-year drop of 18.9% in March. This could suggest some directionality that could lead to growth in the coming months as rates stabilize. Good to note that there is nowhere near enough housing on the market and that there is a glut promoting a buyers’ market.

Another factor suggesting supply will stay low is the low level of foreclosures. Unemployment levels are low, equity is high, and people have low mortgage rates. All these factors lead to a low level of foreclosures which would cause a large number of listings as seen in the past.

Supply chain issues continue to impact new house builds and push prices up for those on the market.

Rates rise but continue to still stay historically low

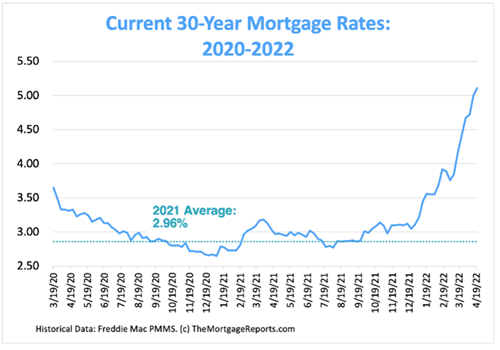

According to forecasts for the coming year, (Rocket Mortgage Article) rates will continue to rise, with rates currently being at their highest in a decade 5.5%.

Analysts at Lending Tree and Bankrate had thought at the beginning of the year that rates would peak at around 3.5 to 4%. However, with rates hovering around 5-6%, this assumption has proven incorrect. Nevertheless, rates are still below levels seen before 2010 (Freddie Mac Article). The last time rates rose in 2018 sales slowed down, impacting sellers’ behavior. Any impact on sales will be dependent on if rates continue to rise.

Looking forward to the Fed continuing its aggressive attitude towards interest rates to keep inflation down, we can expect rates to rise. (The Mortgage Reports Article). However since the Fed has already laid out this plan of increases, mortgage markets may have already factored this into their adjusted rates blunting the impact for the rest of the year and leading to smaller increases.

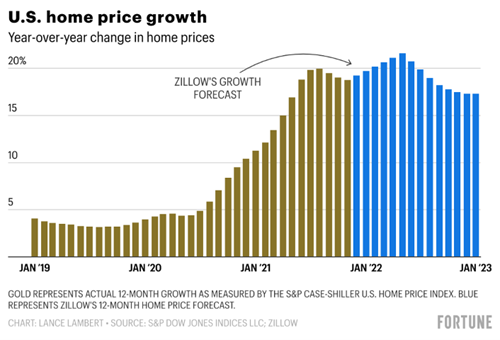

House Prices Remain High

Even with rates rising levels still being palatable for those who need to move, this, along with continued inventory shortage, will push more people to sell but at a continued steady pace and below demand. This will mean that the median home price will continue to increase.

Per data from Realtor.com, it is estimating a rise of 2.9%. (Realtor.com Article) Prices will continue to show a seasonal curve rising over the summer months before reducing again in the fall. Last year home prices rose quickly whilst available volume declined. In 2022 things still look better for sellers rather than buyers but things will improve as the year goes on for buyers (Washington Post Article).

Fear of more rate increases could lead to an urgent rush before rates rise further, which, coupled with reduced inventory, will most likely be key to continued high prices within the real estate market industry.

To learn more or to schedule a strategy session, connect here. At Speedeon, we are dedicated to bringing you the best and most accurate predictive data you can apply to your business decisions and strategy.

Keep learning about the current market trends and consumer behavior: